3 Ways to Create a Better System for Information Management

All Things Admin

APRIL 17, 2024

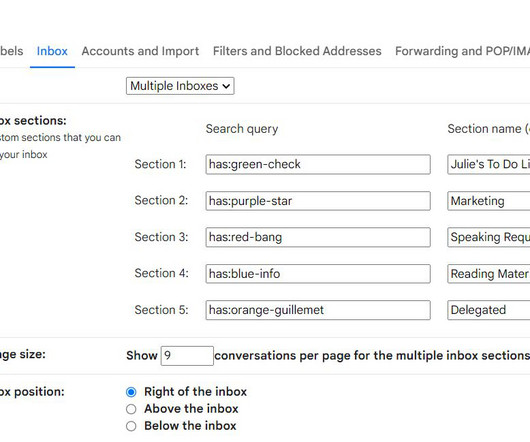

As administrative professionals, managing large amounts of information efficiently is crucial for ensuring smooth operations. Here are three simple yet effective strategies to help you enhance your information management system. In Microsoft Office, categories carry across email, tasks, and calendar.

Let's personalize your content