Rethinking Retirement Plans — Is Phased Retirement The Future?

Allwork

FEBRUARY 3, 2023

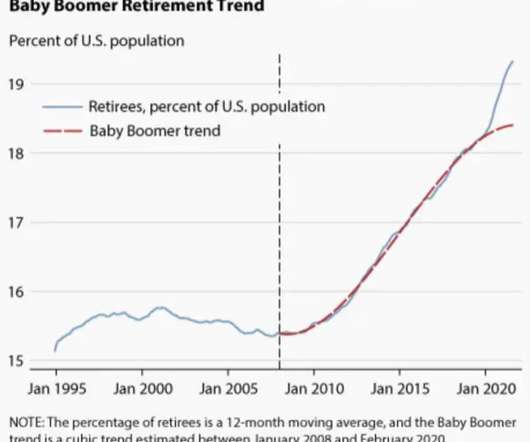

A phased retirement option allows full-time employees to work part-time while also beginning to take some retirement benefits. We spoke to Stacie Haller, ResumeBuilder’s chief career advisor, about whether companies should adopt phased retirement plans. Yet most companies haven’t implemented other options.

Let's personalize your content