The Legal and Tax Complications Faced by Digital Nomads and Their Employers

Small Business Labs

APRIL 6, 2021

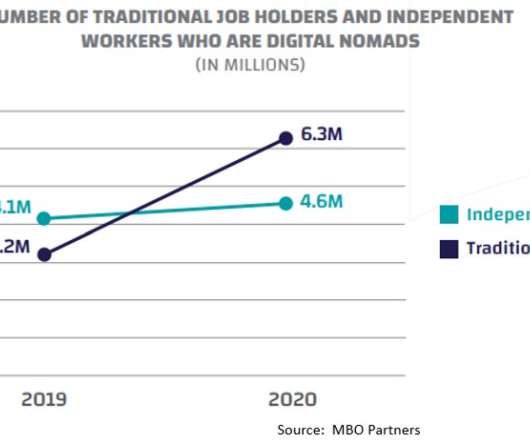

. A quick summary of the article is if you're working remotely, it can be pretty complicated and potentially expensive from a tax perspective. But remote work is even more legally challenging for employers. As the MBO Partners report chart below shows, this growth was mostly driven by digital nomads with traditional jobs.

Let's personalize your content