The “World Footprints” Podcast Shares Untold Stories for Socially-Conscious Travelers

Success

MARCH 4, 2024

Husband-and-wife team Ian and Tonya Fitzpatrick are founders and hosts of the World Footprints travel podcast. Since she had recently returned from living abroad, it was important to her that any potential suitor valued travel. “I My two passions I had were travel and horses. And we thought, ‘How can we form a business?’”

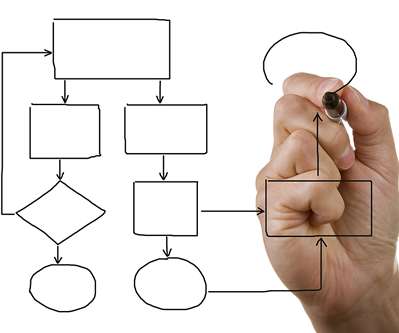

Let's personalize your content