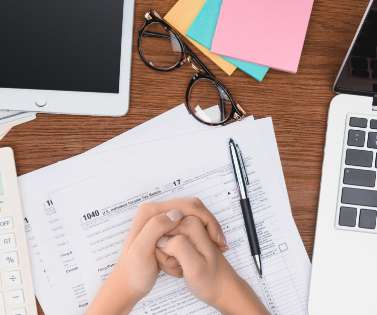

5 Tips to Make Filing Taxes Easier for Freelancers in 2023

Success

MARCH 13, 2023

It can also make things more complicated when it comes to filing taxes. Keep reading for tips for how to do taxes as a freelancer and make filing this year a little easier. Generally, the expenses involved in operating your business or side hustle can be tax-deductible. Becoming your own boss can change your life for the better.

Let's personalize your content