Why It’s Time to Retire the Term “Hybrid Work”

Allwork

JANUARY 6, 2023

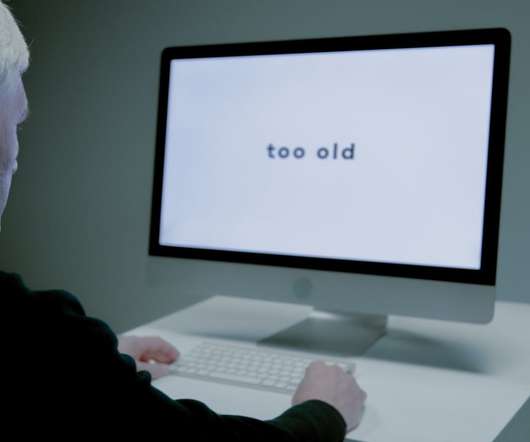

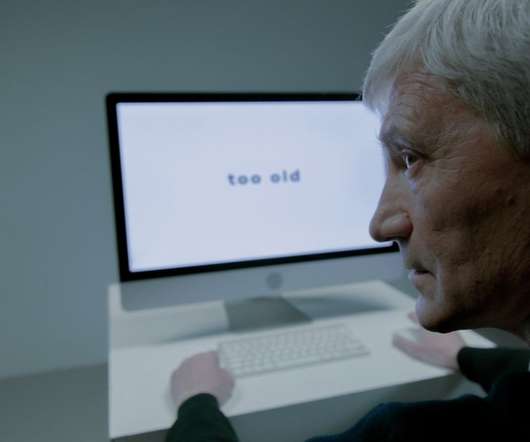

The word “hybrid” gets used a lot relative to workplace strategy, but it may be time to retire the term. . The top short-term factor they saw as being impactful to their business was the expectation of workforce flexibility,” she said, noting that the survey was done in 2018, well before Covid. .

Let's personalize your content