30 New Year’s Resolution Ideas to Make 2024 Healthier, Happier & More Secure

Success

DECEMBER 29, 2023

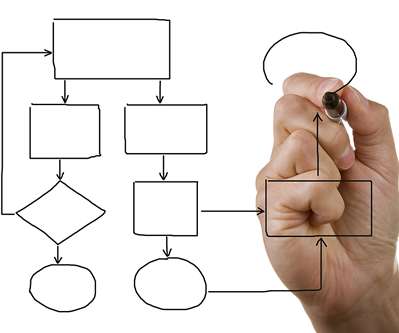

Often, these fall into categories of personal well-being, relationships and finance. New Year’s resolution ideas to improve personal finance Create a monthly budget. Calculate your monthly income, track your spending, determine your goals and priorities and develop a plan to manage your expenses. Review your insurance plans.

Let's personalize your content