How Financial Wellness Programs Can Benefit Employees and Employers

Success

APRIL 17, 2023

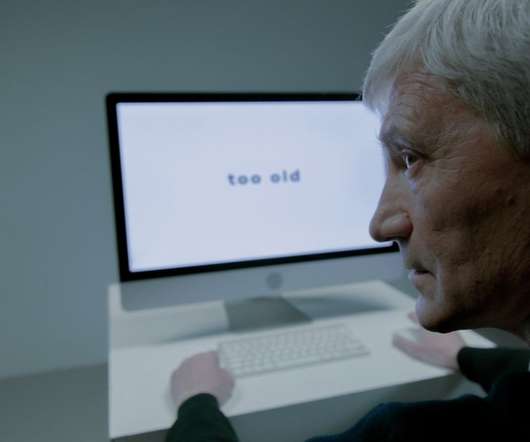

Gone are the days when new employees received a list of the company holidays during onboarding and a packet with information about how to sign up for health care and retirement benefits. As with benefits focused on mental health, interest in financial wellness has increased since the onset of the pandemic, he adds.

Let's personalize your content