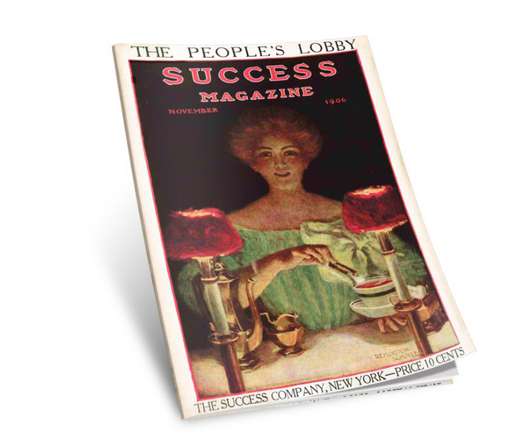

From the Archives: The Ultimate Cost of Penny-Pinching

Success

NOVEMBER 10, 2022

False economy has cost this man very dear. No one can afford to transact important business when they are not in prime condition, and it pays one in health and in comfort, as well as financially, to be very good to oneself , especially when health and a clear brain are our best capital. The Expensive Is Often the Cheapest.

Let's personalize your content