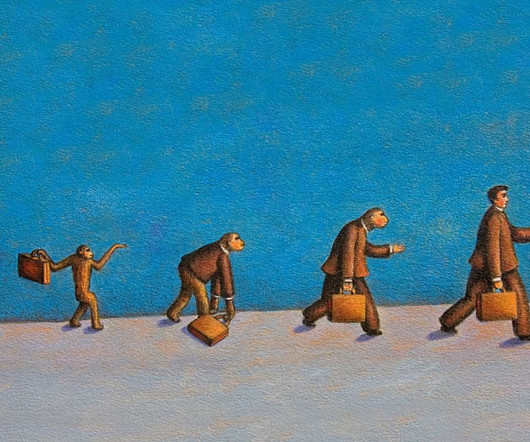

The Anthropology Of Change Management: Four Keys To Success

Allwork

APRIL 23, 2024

Radically altering the daily routines of workers represents a major form of loss. The pandemic marked a form of separation that has been wildly disorienting for many workers, and especially for managers. In what these writers refer to as a dramaturgical approach (i.e. This he refers to as anti-structure.

Let's personalize your content