The Biggest Financial Mistakes to Avoid in Your 40s

Success

APRIL 15, 2024

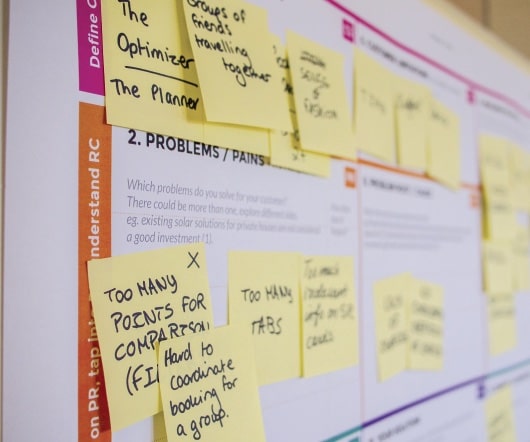

Others may be trying to maximize their retirement savings while filling in the gaps of their parents’ savings. It’s understanding their expenses. It’s not to say, ‘Can you eliminate expenses?’ At moments like these, budgeting , expenses, and income change—and the opportunity to redirect money emerges. Guglielmetti says.

Let's personalize your content