3 Ways to Create a Better System for Information Management

All Things Admin

APRIL 17, 2024

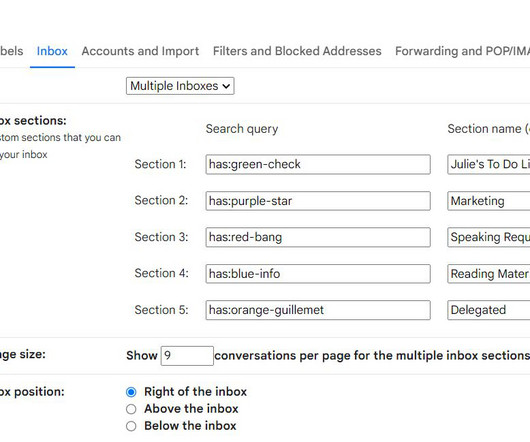

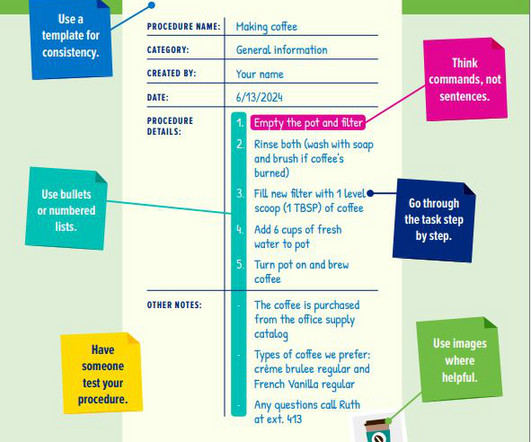

As administrative professionals, managing large amounts of information efficiently is crucial for ensuring smooth operations. Whether it’s handling emails, documents, or projects, having a well-organized system can significantly improve productivity and streamline decision-making processes. Here are two examples of this.

Let's personalize your content