How to Start a Nonprofit Organization In 5 Simple Steps

Success

MARCH 1, 2024

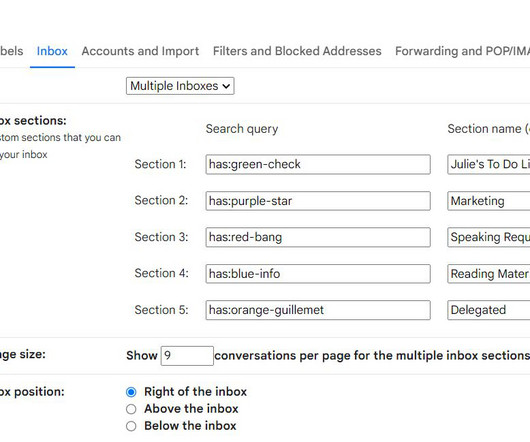

Donors asked if they can deduct the cost of the donated items on their tax return, and a few people suggested you make your project legal by filing for nonprofit status. Form 1023 is the application needed to apply for section 501(c)(3) status. The cost to file Form 1023-EZ is $275. Is there a big enough need for your services?

Let's personalize your content